General Motors is making a bold move. The company has quietly told thousands of its suppliers to remove every single part made in China from vehicles built in North America by early 2027. This is one of the biggest supply chain reworks in the company’s history, and possibly the auto industry’s.

The change could send shockwaves through an already fragile system. For decades, GM relied heavily on Chinese parts for both affordability and availability. Now, it must rebuild its supply base from the ground up, and fast.

A High-Stakes Game

GM’s decision affects more than 2,000 suppliers and up to 300,000 individual parts. Automaker networks are massive, and one missing link can halt production lines. Many suppliers are already warning that the timeline is nearly impossible. The decision comes at a time of growing tension between the U.S. and China, with tariffs and trade restrictions threatening both sides.

These pressures mean automakers must move quickly to protect themselves from supply disruptions or political fallout. The stakes go beyond GM’s bottom line, it’s about how resilient the U.S. automotive industry can become in a world where global supply chains are breaking apart.

Two Decades of Dependence

For over 20 years, GM and other American carmakers have sourced a significant share of their components, especially electronics and specialized tools, from China. This setup worked well when the world was stable, delivering low costs and fast output. Over time, Chinese suppliers have become deeply embedded in every level of the automotive production chain.

But now that connection has turned into a massive liability. GM’s plan effectively means unraveling decades of dependency and rebuilding new systems under a ticking clock.

Why the Pressure Is Mounting

The push to move away from China didn’t happen overnight. Years of trade battles, new tariffs, and supply disruptions have shown how fragile the system really is. Dependence on rare-earth minerals and imported microchips made automakers vulnerable every time geopolitical tensions rose.

GM’s CEO Mary Barra has long championed what she calls supply chain resiliency. That means building systems strong enough to survive global storms and government policy swings.

The Official Announcement

By late 2024, GM made it official. Thousands of suppliers across North America received the directive: phase out all Chinese parts and materials by early 2027.

According to MSN reports, the order represents GM’s most extreme supply chain change ever. While the move is bold, it’s also fraught with risk. Finding reliable replacements in a short time will push even the best suppliers to their limits.

Regional Impact Across North America

This directive zeroes in on GM’s North American operations, where most of its global cars are built. Factories in the United States, Canada, and Mexico now must replace Chinese-sourced components with non-Chinese alternatives. But the hardest parts to replace will be electronics, items like sensors, displays, and circuit boards, where China currently dominates production.

Smaller suppliers may struggle the most, as they often rely on Chinese partners for cost efficiency. Still, supporters argue that if successful, GM’s pivot could set off a new wave of manufacturing revival across North America.

The Human Cost of the Shift

Behind every supply chain are people. Workers in U.S. manufacturing towns and Canadian plants now face an uncertain future. As suppliers re-evaluate their sources, or shut down unviable segments, layoffs may follow.

The Midwest and Ontario, longstanding manufacturing hubs, are expected to feel the strain. The change could create opportunities for new domestic plants, but the short-term turbulence will be intense.

Rivals Reacting

GM isn’t alone in rethinking its relationship with China. Ford, Tesla, and even international brands like Toyota are looking to diversify where they source parts. Yet none are moving at GM’s pace. Meanwhile, U.S. regulators are tightening rules on Chinese tech in cars, citing cybersecurity risks.

The Department of Commerce recently announced it would ban connected Chinese vehicles starting in 2027. The trend suggests that the new competitive edge in auto manufacturing may not be about scale or price, but rather control.

A Global Supply Chain Shift

GM’s decision reflects a much wider global pattern. Across industries, businesses are moving parts of their supply chains closer to home. A mix of trade wars, pandemic experience, and political tension has reshaped how companies define efficiency.

Localization means higher costs at first, but it reduces exposure to global shocks. Logistics Insider reported that automakers are investing billions into U.S. and Mexican facilities, trying to stabilize the flow of materials.

The Risk of Slowdowns

One major side effect of GM’s plan is the danger of production slowdowns. If suppliers cannot find replacements for Chinese parts in time, factories may have to halt production temporarily. Even something as small as a single sensor or wire harness can cause delays of thousands of vehicles.

Automakers are now racing to identify new vendors who can meet GM’s strict quality and delivery standards. The challenge is not just cost, it is ensuring consistent performance under pressure. If GM’s supply base cannot adapt quickly, the company’s 2027 production targets could be at risk, along with profit margins and customer trust.

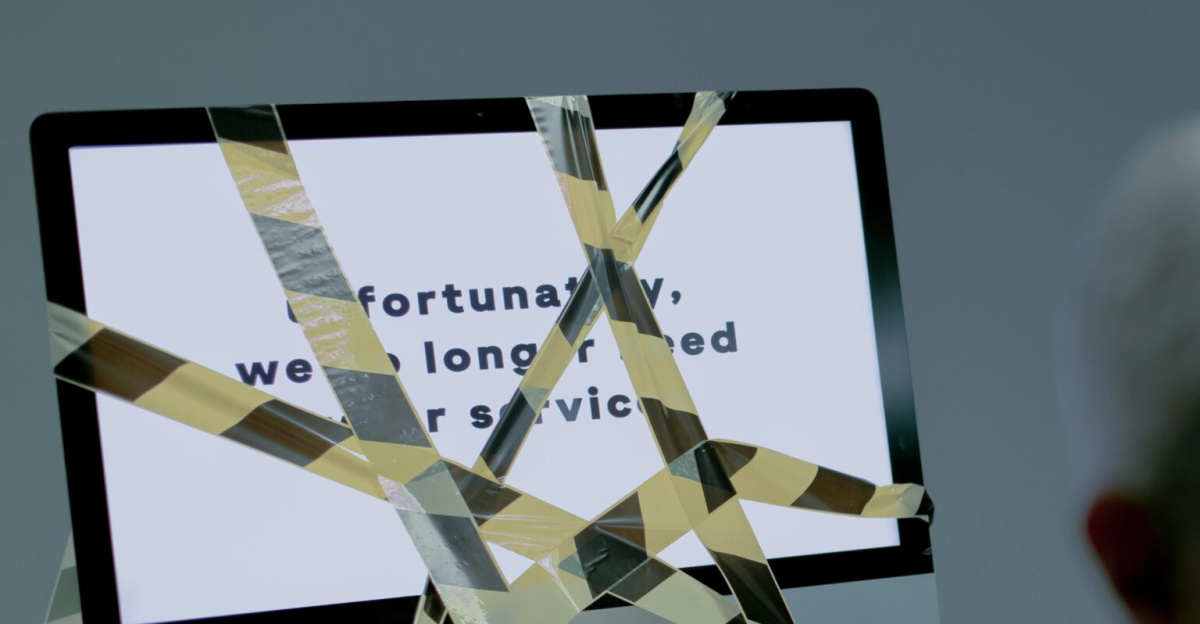

Supplier Frustration Mounting

Many suppliers are now voicing concerns about GM’s expectations. They say that transforming complex supply networks takes time and money, and that timelines this short could cause serious strain. For smaller firms, shifting production lines or qualifying new vendors often means taking on debt or laying off employees.

Larger suppliers may survive, but they risk losing efficiency as they adjust. The atmosphere is tense, and some companies fear the pressure could lead to bankruptcies or contract losses.

Leadership Under Fire

GM CEO Mary Barra is putting her leadership to the test with this move. She has spoken openly about wanting to build a supply chain that can handle today’s unpredictable world. That philosophy is guiding the company’s new direction.

Barra and Shilpan Amin, GM’s global purchasing chief, are leading the charge to identify and certify new suppliers outside China. For them, this is about more than business, it’s about preparing GM for long-term endurance.

GM’s Comeback Strategy

GM is backing its words with action and money. The company has invested in U.S.-based partners to secure supplies of rare-earth metals and lithium, critical materials for electric vehicle batteries. These deals include partnerships with a rare-earth processing firm and an investment in a Nevada lithium mine.

By producing materials closer to home, GM hopes to cut reliance on foreign sources. The plan fits into a national trend where automakers and tech firms are reshoring key materials to North America. While the costs are high now, the payoff could be fewer supply bottlenecks and more energy independence later.

Experts Express Doubt

Not everyone believes GM can meet the 2027 goal. Industry analysts point out that some electronic parts are produced almost entirely in China, with no quick replacements yet available. Rebuilding manufacturing lines elsewhere may take far longer than expected.

Even if GM reduces Chinese content by 80 percent, full separation could remain out of reach for certain components. The company risks higher costs if it relies on smaller domestic suppliers still scaling up capacity.

The Road Ahead

As 2027 gets closer, GM’s bold plan is being watched across the global auto industry. If successful, it could inspire other companies to follow suit, reshaping how cars are built in North America. But if it fails, GM could face major setbacks, production delays, cost overruns, or slower innovation.

Whatever happens, this experiment could define what modern industrial independence looks like for decades to come. GM has placed a huge bet, and the clock is ticking.

Political Fallout

The timing of GM’s decision aligns with a politically tense period between the U.S. and China. The Biden administration has tightened restrictions on Chinese-made technology in vehicles, citing national security concerns. In response, China’s Ministry of Foreign Affairs criticized U.S. policies as protectionism and economic coercion.

This could include tariffs, export restrictions, or barriers for American businesses in China. For GM, which has a major presence there, this diplomatic strain adds yet another layer of uncertainty.

Global Ripple Effects

GM’s decision is being closely watched overseas. The company has large joint ventures and factories in China that serve local markets, meaning any backlash could hurt its position there. Other automakers such as Ford, Volkswagen, and Toyota are monitoring the situation carefully.

If China retaliates against GM, others might have to reconsider their own supply strategies. The ripple effects could shift investment flows, alter trade routes, and redefine how the global car market operates.

Navigating Legal Hurdles

Suppliers are also grappling with new U.S. government rules that restrict the use of Chinese technology in any car sold domestically. That means even if a part is assembled in an American factory, it could still be banned if it contains Chinese hardware or software.

The new rules, effective by 2027, are forcing suppliers to trace every input in their products, right down to the chips. Adjusting to these laws adds time, cost, and complexity, but ignoring them could lead to fines or halted shipments.

A Cultural Turning Point

The shift away from China isn’t just about economics, it signals a cultural change in how America builds things. For decades, globalization meant going wherever production was cheapest. Now, the focus is moving toward reliability, regional sourcing, and security.

For GM, the challenge is to revive a manufacturing culture that prizes long-term stability over short-term savings. This adjustment could reshape how future engineers, managers, and policymakers think about industrial strength in the modern era.

The Big Picture

GM’s supply chain overhaul is more than a company decision, it’s a sign of where American industry is heading. As the world becomes more unpredictable, flexibility and independence will matter more than just cost-cutting.

In this new era, the companies that can adapt the fastest, and build the strongest local supply bases, will be the ones that thrive. GM’s journey could mark the beginning of a new chapter for manufacturing in North America.